Mentoring Helps Ensure Success of Succession Planning

Many times, succession planning involves selling to an employee group or family member. Because this often means seller financing, it's important to develop your management team so that they can take over even before you step aside to ensure the long term success of the business.

Anticipate your Business Strategy with a Buy Sell Agreement

100 percent of businesses end at some point. If you have one or more business partners, start the relationship with a business prenuptial - a buy-sell agreement - as part of your exit strategy for your business. Steve hits some of the important aspects of a buy-sell agreement as a good business strategy.

Understanding Due Diligence An Integral Part of Selling Your Business

Wise buyers insist on a detailed due diligence process to make sure that the business is a wise investment. Wise sellers anticipate this and gather this due diligence information prior to listing the business. Work with your attorney or other advisor to anticipate the buyer's requests and put this package together ahead of time.

Help your Buyer Finance the Purchase of your Business

Do your best to avoid seller financing when selling your business. Look for ways to help your buyer to close the transaction and give you cash. Steve offers some ideas to help you find those financing opportunities.

Should I Sell Business Divisions Separately vs Sell the Company as a Whole

Steve shares some thoughts to consider when selling your business. Often, it can make more sense to divide the company and sell the divisions separately. Other times, there is a synergy that is only available when the company is whole. Discover more about how this might apply to your situation.

Run your Business According to your Exit Strategy

From the start of your business, plan your exit strategy. To whom will you sell your business?

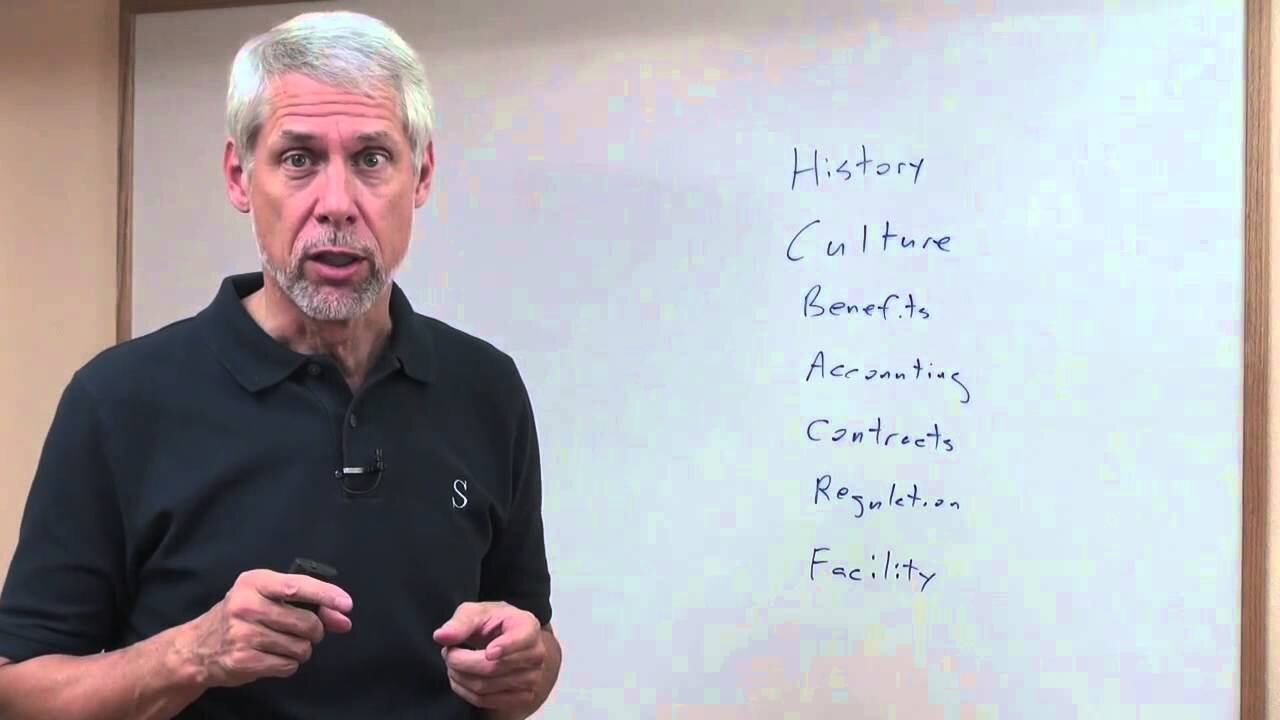

Questions to Ask When Buying a Business Part 1: Seven Often Overlooked Considerations

There is much more to consider than the purchase price when you are buying a business. Steve outlines seven primary questions to ask when buying a business so that you have a full understanding of what you are getting for that purchase price. Whether it is company culture or industry regulation, you will want to understand how considerations such as these will impact your long term success, and subsequently your buying decision. Be sure to talk to your current business advisors for more information on how these questions to ask when buying a business might impact your particular situation, or talk with Steve via email or phone to get his advice.

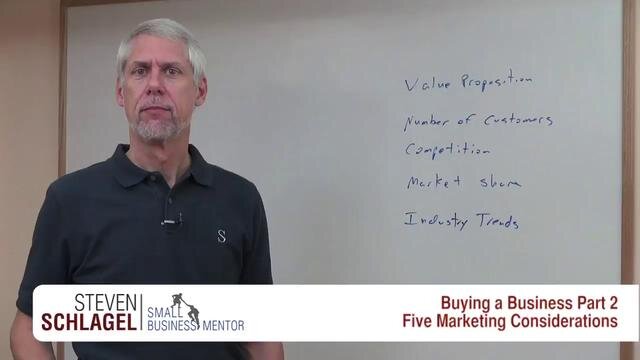

Questions to Ask When Buying a Business, Part 2: Five Primary Marketing Issues

Look beyond the purchase price and financial track record when you are buying a business. Steve outlines five primary marketing questions to ask when buying a business so that you have a full understanding of the company's market and its value proposition to its customers. Marketing considerations such as these will impact your long term success, and subsequently your buying decision. Be sure to talk to your current business advisors for more information on how these questions to ask when buying a business might impact your particular situation, or talk with Steve via email or phone to get his advice.

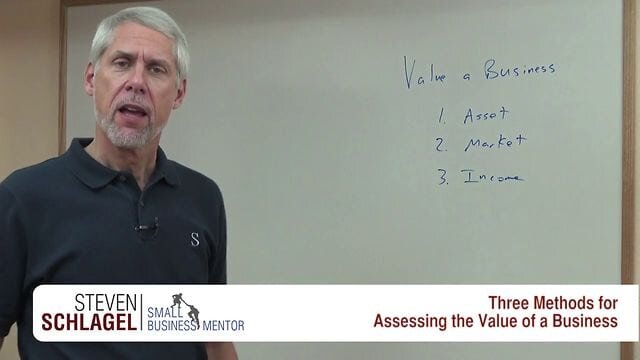

The Business Buying Process: Three Methods for Assessing Value

Accurately determining the value of a business is an important part of the business buying process. Explore the three primary ways that Certified Valuation Analysts use to assess the value of a particular business. Whether you are buying a business or selling a business, an accurate valuation takes all three of these methodologies into account, then uses the one most appropriate for your situation Discover how these different approaches can affect the value and subsequently impact the business buying process.

Determining Business Value - The Income Method

Discover more about this straightforward, common sense approach to help you value a business with the Income approach. Whether you are buying a business or selling a business, this simple explanation of the Income valuation approach will be helpful and will give you something to use as comparison when talking value with brokers or colleagues. Basic, rule-of-thumb lessons such as this one can't consider all of the small details involved in determining an accurate business value, so don't make a purchase or sale based only on this. Talk to your current business advisors about how cash flow and cap rate apply to your particular situation, or talk with Steve via email or phone to get his advice.

Use a Buy Sell Agreement from the Start

Learn why it is critically important that you agree upfront how to disassemble your partnership.

Buying a Competitor's Business: Increasing Marketshare in a Difficult Economy

Steve explains how buying a competitor's business makes sense in an economic downturn and can pay handsomely when the economy rebounds. Some of your competitors will not be able to weather an economic downturn, offering you an opportunity to increase marketshare. When competitors struggle, buying a competitor's business - or at least their client list - allows you to increase your marketshare - even in a difficult economy.

Buying an Established Business? Five Different Resources for Finding the Right Opportunity

Explore these five different options when looking to buy a established business. This list of resources includes both online and offline listings, and many are offered at no cost to you. Steve shares five valuable (but sometimes overlooked) sources to help you find the right opportunity for buying an established business.

Buy an Existing Business or Start a New Business from Scratch?

Consider the pros and cons of buying an existing business vs. starting a brand new business. The decision to buy an existing business is much different from starting a new business from the ground up, and while there is no ONE right answer that fits each person, your own clarity about your approach to business will help you make the best choice for you. Discover how your investment of time and money, as well as relationships with customers, vendors, and employees, figure into your decision to start a new business OR buy an existing business.