Mentoring Helps Ensure Success of Succession Planning

Many times, succession planning involves selling to an employee group or family member. Because this often means seller financing, it's important to develop your management team so that they can take over even before you step aside to ensure the long term success of the business.

Anticipate your Business Strategy with a Buy Sell Agreement

100 percent of businesses end at some point. If you have one or more business partners, start the relationship with a business prenuptial - a buy-sell agreement - as part of your exit strategy for your business. Steve hits some of the important aspects of a buy-sell agreement as a good business strategy.

Should I Sell Business Divisions Separately vs Sell the Company as a Whole

Steve shares some thoughts to consider when selling your business. Often, it can make more sense to divide the company and sell the divisions separately. Other times, there is a synergy that is only available when the company is whole. Discover more about how this might apply to your situation.

How to Manage the Three Different Types of Employees that Make Up Your Workforce

Explore the different ways to lead and collaborate with the three different types of employees that exist within your workforce.

Four Steps to Finding the Best CPA for Your Business

It's important to have a good business advisor! Explore these four areas for consideration when choosing the best CPA to help make you and your business successful…

Why Should I Hire a Small Business Coach, Consultant , or Mentor?

Discover how collaborating with a Small Business Coach, Consultant or Mentor can have a positive impact on your small business. Is there a need or skill that you need to learn or develop to help grow your business? A small business mentor can help you strengthen a weakness or help you learn a new skill to improve your business so you can get to the next level.

What is the Difference Between a Small Business Consultant, Coach or Mentor?

Discover the ways in which you can distinguish between a Consultant, Coach, or Mentor. Whether you want to solve a problem, build a skill, or work with a wise sounding board, understanding the differences among these three different functions will help ensure your success.Steven Schlagel is a CPA and Attorney with offices in both Durango, CO and Farmington, NM. More than the typical CPA, Steve mentors, coaches and consults with small business owners just like you every day to help them solve problems and build value in their business.

Time is True Wealth

Time is the currency that allows us the freedom to do the things that make life worth living.

Paying a Livable Wage as a Business Strategy

Discover how paying a livable wage to your employees helps attract and retain great employees while supporting your business strategy.

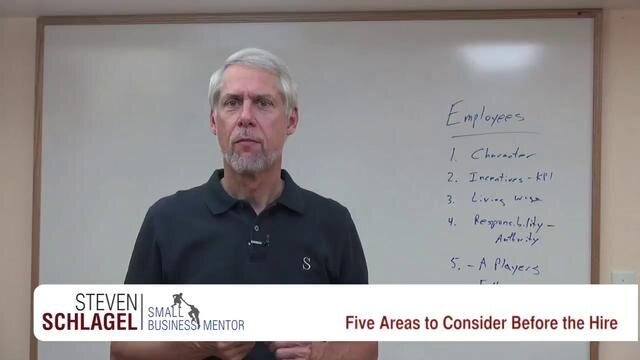

Five Areas to Consider Before the Hire

Explore these five considerations when deciding which candidate to hire for the job.

Overcoming Roadblocks in an Uncertain Economy

Discover four ways to thrive in a challenging economy.

Understanding Your Company's Financial Statements

Discover more about what your financial statements tell you about the health of your small business.

Diversify Your Business to Weather an Uncertain Economy

Explore four reasons to diversify your business in the face of this uncertain economy.

The Business Buying Process: Three Methods for Assessing Value

Accurately determining the value of a business is an important part of the business buying process. Explore the three primary ways that Certified Valuation Analysts use to assess the value of a particular business. Whether you are buying a business or selling a business, an accurate valuation takes all three of these methodologies into account, then uses the one most appropriate for your situation Discover how these different approaches can affect the value and subsequently impact the business buying process.

Determining Business Value - The Income Method

Discover more about this straightforward, common sense approach to help you value a business with the Income approach. Whether you are buying a business or selling a business, this simple explanation of the Income valuation approach will be helpful and will give you something to use as comparison when talking value with brokers or colleagues. Basic, rule-of-thumb lessons such as this one can't consider all of the small details involved in determining an accurate business value, so don't make a purchase or sale based only on this. Talk to your current business advisors about how cash flow and cap rate apply to your particular situation, or talk with Steve via email or phone to get his advice.

Finding, Hiring & Retaining Great Employees

Explore four considerations when adding a new employee to your team.

Think Strategically for Business Success

Discover why a well thought-out strategy is instrumental to your small business success.

Case Study - Using Key Predictive Indicators

Continental Airlines employed a simple focus on Key Predictive Indicators to turn the company around.

Discover How to Order Your Business Priorities

Focus your time on maximizing sales in order to have a bigger impact on your business success.

Explore Alternatives, Then Focus on a Few

Discover how focus on a few products or services can bring you business success, but only after evaluating multiple ideas.