Time is True Wealth

Time is the currency that allows us the freedom to do the things that make life worth living.

Paying a Livable Wage as a Business Strategy

Discover how paying a livable wage to your employees helps attract and retain great employees while supporting your business strategy.

Best Business Plan Format

The best business plan format is one simple enough to be easily understood by all, detailed enough to be useful, and conservative enough to provide a margin for error and changing times.

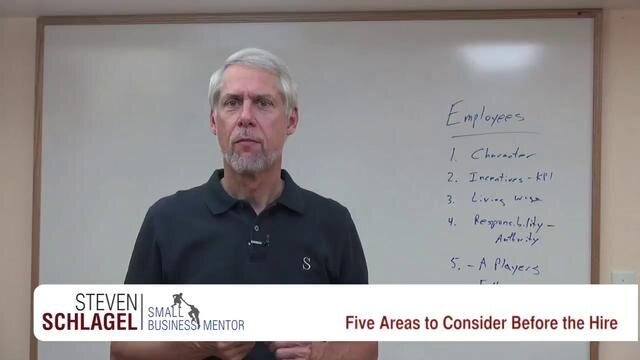

Five Areas to Consider Before the Hire

Explore these five considerations when deciding which candidate to hire for the job.

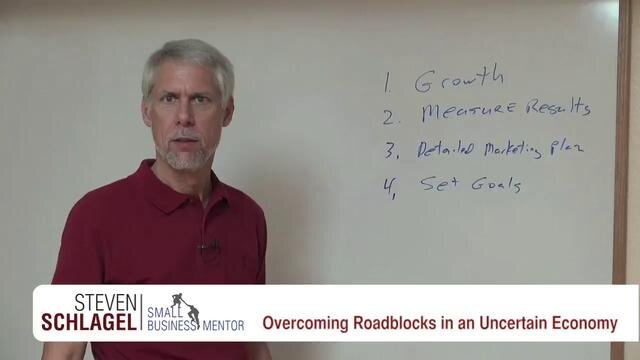

Overcoming Roadblocks in an Uncertain Economy

Discover four ways to thrive in a challenging economy.

Understanding Your Company's Financial Statements

Discover more about what your financial statements tell you about the health of your small business.

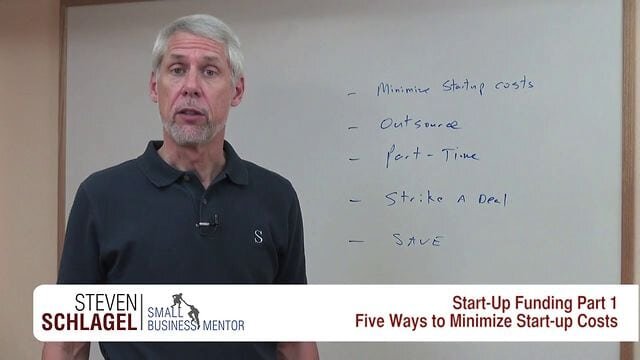

Start-Up Funding, Part 1 - Five Ways to Minimize Start-Up Costs

How much does it cost to start a business? Steve offers five ideas that can help you minimize any start up funding. Use these ideas to find what works best for your strategy, helping make yours one of the most profitable small businesses possible. This video is the first of two videos to address start up funding. Start here to reduce start up costs as much as possible. Then - if necessary - review the second video to help you find sources of funding for your start up.

Diversify Your Business to Weather an Uncertain Economy

Explore four reasons to diversify your business in the face of this uncertain economy.

Questions to Ask When Buying a Business, Part 2: Five Primary Marketing Issues

Look beyond the purchase price and financial track record when you are buying a business. Steve outlines five primary marketing questions to ask when buying a business so that you have a full understanding of the company's market and its value proposition to its customers. Marketing considerations such as these will impact your long term success, and subsequently your buying decision. Be sure to talk to your current business advisors for more information on how these questions to ask when buying a business might impact your particular situation, or talk with Steve via email or phone to get his advice.

The Business Buying Process: Three Methods for Assessing Value

Accurately determining the value of a business is an important part of the business buying process. Explore the three primary ways that Certified Valuation Analysts use to assess the value of a particular business. Whether you are buying a business or selling a business, an accurate valuation takes all three of these methodologies into account, then uses the one most appropriate for your situation Discover how these different approaches can affect the value and subsequently impact the business buying process.

Determining Business Value - The Income Method

Discover more about this straightforward, common sense approach to help you value a business with the Income approach. Whether you are buying a business or selling a business, this simple explanation of the Income valuation approach will be helpful and will give you something to use as comparison when talking value with brokers or colleagues. Basic, rule-of-thumb lessons such as this one can't consider all of the small details involved in determining an accurate business value, so don't make a purchase or sale based only on this. Talk to your current business advisors about how cash flow and cap rate apply to your particular situation, or talk with Steve via email or phone to get his advice.

Finding, Hiring & Retaining Great Employees

Explore four considerations when adding a new employee to your team.

Start-Up Funding Part 2 - Six Sources of Start Up Funding

Discover six sources of funding for your start up business. While Steve encourages his clients to be very conservative about taking on business debt - "a borrower is a slave to the lender" - he recognizes that there are times when debt becomes a necessary source of start up funding. Watch Part 1 of this series to first minimize your start up costs before you use this video to help you evaluate which sources of funding are right for you and your start up business. Then proceed with caution and a plan for paying it back to ensure yours is one of the most profitable small businesses possible.

Think Strategically for Business Success

Discover why a well thought-out strategy is instrumental to your small business success.

Case Study - Using Key Predictive Indicators

Continental Airlines employed a simple focus on Key Predictive Indicators to turn the company around.

Is There Truly a Market for Your Proposed Product or Service?

Whether you are buying an existing business or starting a new business, take the time to test market your proposed product or service. Your customer is the one who ultimately decides whether your business succeeds or fails, so be sure that potential customers are willing to part with their hard-earned cash to vote in favor of your product or service. One of the advantages of buying an existing business is knowing that a market already exists, but it would be wise to investigate further so that you fully understand that market.

Discover How to Order Your Business Priorities

Focus your time on maximizing sales in order to have a bigger impact on your business success.

Explore Alternatives, Then Focus on a Few

Discover how focus on a few products or services can bring you business success, but only after evaluating multiple ideas.

Interview to Discover Character and Attitude

Learn how to ask questions that will help you understand the character and attitude of the person you are interviewing.

Use Key Predictive Indicators to Help Employees Succeed

Think about KPI's - the two or three actions that will indicate success - when communicating expectations to an employee.