Mentoring Helps Ensure Success of Succession Planning

Many times, succession planning involves selling to an employee group or family member. Because this often means seller financing, it's important to develop your management team so that they can take over even before you step aside to ensure the long term success of the business.

Charge an Application Fee When Hiring to Help Pre-Qualify Candidates

Run of the mill recruiting brings you a LOT of unqualified applicants. Before you invest your time and money screening those applicants - reviewing applications, paying for drug screens and background checks - why not consider charging an application fee to prospective employees? You might find that those who are unqualified won't pay the fee and you're left with a smaller, more qualified pool of applicants to choose from.

3 Bad Habits That Can Kill Your New Business Venture

Starting your own business? You'll be faced with a wide variety of bad habits to conquer. Many of these result from simple human nature.

Questions to Ask When Buying a Business Part 1: Seven Often Overlooked Considerations

There is much more to consider than the purchase price when you are buying a business. Steve outlines seven primary questions to ask when buying a business so that you have a full understanding of what you are getting for that purchase price. Whether it is company culture or industry regulation, you will want to understand how considerations such as these will impact your long term success, and subsequently your buying decision. Be sure to talk to your current business advisors for more information on how these questions to ask when buying a business might impact your particular situation, or talk with Steve via email or phone to get his advice.

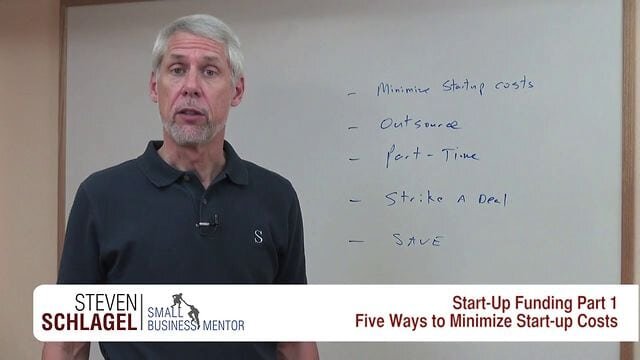

Start-Up Funding, Part 1 - Five Ways to Minimize Start-Up Costs

How much does it cost to start a business? Steve offers five ideas that can help you minimize any start up funding. Use these ideas to find what works best for your strategy, helping make yours one of the most profitable small businesses possible. This video is the first of two videos to address start up funding. Start here to reduce start up costs as much as possible. Then - if necessary - review the second video to help you find sources of funding for your start up.

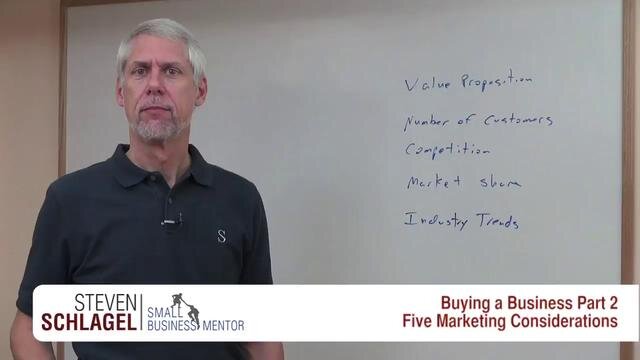

Questions to Ask When Buying a Business, Part 2: Five Primary Marketing Issues

Look beyond the purchase price and financial track record when you are buying a business. Steve outlines five primary marketing questions to ask when buying a business so that you have a full understanding of the company's market and its value proposition to its customers. Marketing considerations such as these will impact your long term success, and subsequently your buying decision. Be sure to talk to your current business advisors for more information on how these questions to ask when buying a business might impact your particular situation, or talk with Steve via email or phone to get his advice.

The Business Buying Process: Three Methods for Assessing Value

Accurately determining the value of a business is an important part of the business buying process. Explore the three primary ways that Certified Valuation Analysts use to assess the value of a particular business. Whether you are buying a business or selling a business, an accurate valuation takes all three of these methodologies into account, then uses the one most appropriate for your situation Discover how these different approaches can affect the value and subsequently impact the business buying process.

Determining Business Value - The Income Method

Discover more about this straightforward, common sense approach to help you value a business with the Income approach. Whether you are buying a business or selling a business, this simple explanation of the Income valuation approach will be helpful and will give you something to use as comparison when talking value with brokers or colleagues. Basic, rule-of-thumb lessons such as this one can't consider all of the small details involved in determining an accurate business value, so don't make a purchase or sale based only on this. Talk to your current business advisors about how cash flow and cap rate apply to your particular situation, or talk with Steve via email or phone to get his advice.

Start-Up Funding Part 2 - Six Sources of Start Up Funding

Discover six sources of funding for your start up business. While Steve encourages his clients to be very conservative about taking on business debt - "a borrower is a slave to the lender" - he recognizes that there are times when debt becomes a necessary source of start up funding. Watch Part 1 of this series to first minimize your start up costs before you use this video to help you evaluate which sources of funding are right for you and your start up business. Then proceed with caution and a plan for paying it back to ensure yours is one of the most profitable small businesses possible.

Is There Truly a Market for Your Proposed Product or Service?

Whether you are buying an existing business or starting a new business, take the time to test market your proposed product or service. Your customer is the one who ultimately decides whether your business succeeds or fails, so be sure that potential customers are willing to part with their hard-earned cash to vote in favor of your product or service. One of the advantages of buying an existing business is knowing that a market already exists, but it would be wise to investigate further so that you fully understand that market.

Crafting Your Company's Value Proposition

You already know how important it is to test market your product or service whether you are buying an existing business or starting a new business. It's equally important to articulate why customers should buy from you instead of one of your competitors. What makes you different? What is your business's unique selling proposition? Hint: "we do it better, faster, etc." isn't it - everyone says that. Steve encourages you to take some time to really explore all the ways you can distinguish yourself from your competitors. Ask your own business advisors to assist with the process, or ask Steve by phone or email to help further the process.

Buying a Competitor's Business: Increasing Marketshare in a Difficult Economy

Steve explains how buying a competitor's business makes sense in an economic downturn and can pay handsomely when the economy rebounds. Some of your competitors will not be able to weather an economic downturn, offering you an opportunity to increase marketshare. When competitors struggle, buying a competitor's business - or at least their client list - allows you to increase your marketshare - even in a difficult economy.

What Do Your Customers Want

Thinking about your business from the customer side of the table will help ensure that you are meeting and exceeding customer expectations, ultimately leading to your long term business success. Success in your business is ultimately determined by your customers - not you, your product or service, or even your employees. Whether you are considering buying a business or starting a business, Steve encourages you to put forth the time and effort to discover, understand, and measure what matters to your customers.

What is a Small Business Consultant?

Discover guidelines that will help you determine how a small business consultant might help solve the problems you face in your business.

How Do I Select a Consultant, Coach, or Mentor?

Learn seven different criteria that will help you select the best consultant, coach or mentor for you and your business.

Buying an Established Business? Five Different Resources for Finding the Right Opportunity

Explore these five different options when looking to buy a established business. This list of resources includes both online and offline listings, and many are offered at no cost to you. Steve shares five valuable (but sometimes overlooked) sources to help you find the right opportunity for buying an established business.

Buy an Existing Business or Start a New Business from Scratch?

Consider the pros and cons of buying an existing business vs. starting a brand new business. The decision to buy an existing business is much different from starting a new business from the ground up, and while there is no ONE right answer that fits each person, your own clarity about your approach to business will help you make the best choice for you. Discover how your investment of time and money, as well as relationships with customers, vendors, and employees, figure into your decision to start a new business OR buy an existing business.

Traits of a Successful Small Business Owner

The traits of a successful small business owner include their skills and talents, their character, their attitude, their passion, and their dedication to learning and adhering…

Think Like an Entrepreneur!

I talk a lot about the nuts and bolts of starting or buying and running a small business.

Starting a Business With Little or No Cash

Many people dream of starting a business, but fear they can't because they have little upfront cash.